Tired of Overpriced Stocks

and "Return Free Risk" Bonds?

Become a Member of Massengill's Defense Technology Alert

Massengill’s Defense Technology Alert is your behind the scenes access to the most potentially profitable opportunities in the defense technology sector.

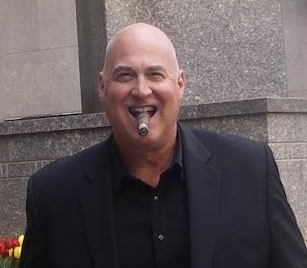

With invaluable contacts and experience as both a senior U.S. defense industry executive and a managing director of a boutique Manhattan investment bank, Kevin Massengill has developed his proprietary D.R.O.N.E. system to target the most potentially profitable defense technology stocks currently available.

Applying the same principles of deep value analysis as outlined in Benjamin Graham’s Intelligent Investor, Seth Klarman’s Margin of Safety, and Tobias Carlisle’s,The Acquirer’s Multiple, our Defense Technology Alert is a research service identifying outstanding micro, small and mid-cap companies in defense and security that are currently trading at a discount to their net current asset value (NCAV).

As a subscriber to Defense Technology Alert, one of the top performing investment newsletters in Agora Financial, you’ll receive a new investment recommendation every month as well as a detailed report on our current defense tech model portfolio companies.

Since we started Defense Technology Alert in January 2017, we’ve already seen some fantastic gains. Our readers could have realized gains of 289% on SKAS, 168% on BA calls, 95% on GD calls and 94% on RTN calls. In fact, we’ve seen gains on nine out of the 11 closed positions in our model portfolio.

Here’s what some of Defense Technology Alert’s paid subscribers are saying…

With invaluable contacts and experience as both a senior U.S. defense industry executive and a managing director of a boutique Manhattan investment bank, Kevin Massengill has developed his proprietary D.R.O.N.E. system to target the most potentially profitable defense technology stocks currently available.

Applying the same principles of deep value analysis as outlined in Benjamin Graham’s Intelligent Investor, Seth Klarman’s Margin of Safety, and Tobias Carlisle’s,The Acquirer’s Multiple, our Defense Technology Alert is a research service identifying outstanding micro, small and mid-cap companies in defense and security that are currently trading at a discount to their net current asset value (NCAV).

As a subscriber to Defense Technology Alert, one of the top performing investment newsletters in Agora Financial, you’ll receive a new investment recommendation every month as well as a detailed report on our current defense tech model portfolio companies.

Since we started Defense Technology Alert in January 2017, we’ve already seen some fantastic gains. Our readers could have realized gains of 289% on SKAS, 168% on BA calls, 95% on GD calls and 94% on RTN calls. In fact, we’ve seen gains on nine out of the 11 closed positions in our model portfolio.

Here’s what some of Defense Technology Alert’s paid subscribers are saying…

Reviews for Massengill's Defense Technology Alert:

"I made a total gain of $25,500 from trading four call options. I would definitely encourage [my friends] to subscribe to Defense Tech Alert. This is one good project." - JunPei Y. |

"[I'm up] about $5,000 since March '17. I would highly recommend your service to any new potential subscriber, if they want to increase their earning potential." - John S. |

“Very good and interesting. In my honest opinion, probably leading edge information in the field.” - Arthur S. |

“I love it and already made a little money; thanks for the hard and very detailed work!” - Grace H |

“Great analysis. Mr. Massengill’s experience, combined with his depth and breadth of knowledge from both the military and private sectors, enhanced by his understanding of the markets, is superb. He takes a complicated analysis and makes it understandable. There is no way I could understand and invest in this sector, much less the thinly traded stocks that are the up and comers, without his guidance.” - Daniel G.

Your Invitation...

Worried about an overpriced stock market and tired of "return free risk" with your bonds?

Concerned about the logic of a passive index funds where, as Howard Marks points out, "...neither individual holdings nor portfolio construction is the subject of thoughtful analysis and decision-making, and in which buying takes place regardless of price?"

Looking for something with minimal downside risk but enormous upside potential to add some pop to an otherwise defensive portfolio?

President Trump is facing wide ranging threats from North Korea, Iran, China and Russia and has pledged to rebuild America's defenses.

These tiny companies may be showered with a minimum of $19 billion in government contracts - kicking off the largest explosion of profits in more than six decades.

That means that right now is the perfect time to position yourself in the only market in the world that can bring terrific returns when every other market is falling apart...

Concerned about the logic of a passive index funds where, as Howard Marks points out, "...neither individual holdings nor portfolio construction is the subject of thoughtful analysis and decision-making, and in which buying takes place regardless of price?"

Looking for something with minimal downside risk but enormous upside potential to add some pop to an otherwise defensive portfolio?

President Trump is facing wide ranging threats from North Korea, Iran, China and Russia and has pledged to rebuild America's defenses.

These tiny companies may be showered with a minimum of $19 billion in government contracts - kicking off the largest explosion of profits in more than six decades.

That means that right now is the perfect time to position yourself in the only market in the world that can bring terrific returns when every other market is falling apart...

Follow Kevin Massengill at...

"Intelligent individuals learn from every thing and every one; average people, from their experiences.

The stupid already have all the answers." — Socrates

The stupid already have all the answers." — Socrates